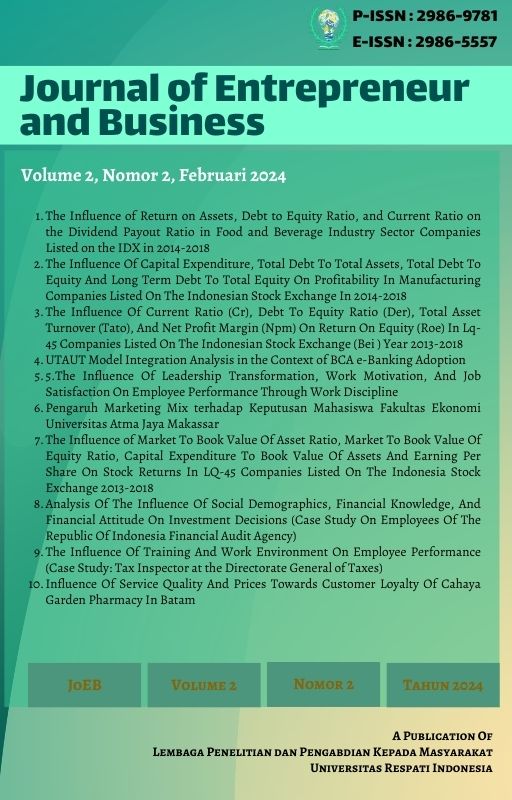

The Influence of Return on Assets, Debt to Equity Ratio, and Current Ratio on the Dividend Payout Ratio in Food and Beverage Industry Sector Companies Listed on the IDX in 2014-2018

DOI:

https://doi.org/10.52643/joeb.v2i2.47Abstract

This study aims to analyze the effect of Return on Assets, Debt to Equity Ratio, and Current Ratio on Divident Payout Ratio on food and beverage industry sector companies listed on the Indonesia Stock Exchange in 2014 until 2018. This research is an explanatory research that explains the effect the dependent variable on the independent variable using secondary data with a population of 14 companies and the sample taken as many as 6 companies that meet the specified criteria. The analytical method used is multiple linear regression. The results showed that at 95% confidence level of the three dependent variables studied were: Return on Assets, Debt to Equity Ratio and Current Ratio there was one variable that had a significant effect on the Divident Payout Ratio, namely Debt to Equity Ratio (DER). Meanwhile, if tested simultaneously, Return on Assets, Debt to Equity Ratio, and Current Ratio significantly influence the Divident Payout Ratio.

Keywords : Return on Asset, Debt to Equity Ratio, Current Ratio, and Devident Payout Ratio